Debt Consolidation Benefits for New Parents: 3 Key Ways

Debt Consolidation Benefits for New Parents: 3 Key Ways

Achieve Financial Peace of Mind: Explore 3 Key Benefits of Debt Consolidation for New Parents

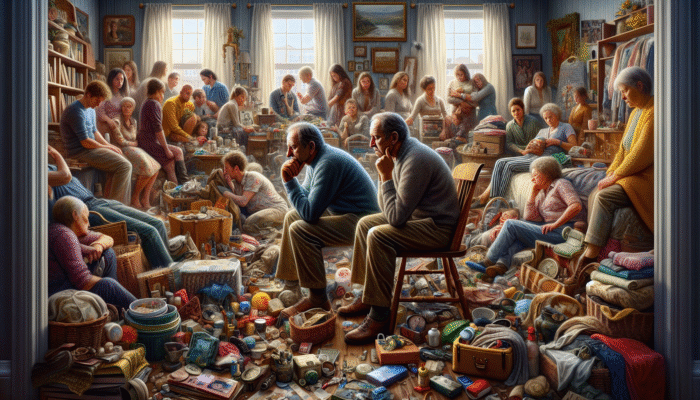

Uncover How Debt Consolidation Can Provide New Parents with Financial Relief and Stability Congratulations on the beautiful journey of parenthood! While this new chapter is filled with joy, it also brings along a range of financial responsibilities. As new parents, many find themselves overwhelmed by rising expenses, including costs for baby products, healthcare, and other necessities. Debt consolidation can serve as a crucial tool for easing this burden by simplifying your financial obligations and potentially lowering your monthly payments. By combining multiple debts into a single loan with a lower interest rate, new parents can alleviate financial stress, enabling them to focus more on nurturing their family. This article highlights three significant benefits of debt consolidation specifically designed for new parents, illustrating how it can lead to a more secure financial future.

Apply for a Debt Consolidation Loan Online Today

Apply for a Debt Consolidation Loan Online Today

Streamline Your Finances: Apply for a Debt Consolidation Loan Online Today

Discover How Online Applications for Debt Consolidation Loans Simplify Your Financial Journey In the modern digital landscape, the process of applying for debt consolidation loans has become remarkably straightforward and efficient. This approach enables individuals to confront their financial challenges without the hassles associated with traditional banking procedures. If you are juggling multiple debts and seeking a viable solution, the convenience of online applications allows you to manage the process from the comfort of your own home. This not only saves valuable time but also empowers you to compare various loan options with ease. In this article, we will explore the extensive advantages of applying for a debt consolidation loan online, detailing how this method can significantly improve your financial management and pave the way for a brighter financial outlook.

Debts During the Coronavirus Pandemic

Debts During the Coronavirus Pandemic

Navigating Debt Management Challenges During the Coronavirus Pandemic: Key Strategies for Resilience

Adopt Effective Debt Management Strategies to Overcome Financial Strain During the COVID-19 Pandemic The COVID-19 pandemic has profoundly altered our lives, introducing unprecedented challenges to job security and income stability. Many families and individuals have encountered heightened financial pressures, often leading to increased debt burdens. If you find yourself among those struggling with <a href="https://cityaccommodations.com.au/debts-impact-on-mental-health-understanding-the-link/">debt</a> during these uncertain times, it is vital to implement effective strategies for managing your financial commitments. This article presents essential approaches to successfully navigate your debt throughout the pandemic, including exploring options like debt consolidation, utilizing government support programs, and employing effective budgeting techniques. These strategies can help you regain control over your finances, ensuring long-term stability and peace of mind.

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

Thorough Examination of the Advantages and Disadvantages of Debt Consolidation Loans in the UK

Gain Valuable Insights into Debt Consolidation Loans and Their Impact on Your Financial Future Understanding the world of debt consolidation loans in the UK is essential for anyone aiming to regain control over their financial situation. These loans can offer significant advantages, such as reduced interest rates and simplified repayment structures, but they also present potential drawbacks that warrant careful evaluation. This article will thoroughly dissect the various pros and cons associated with debt consolidation loans, providing you with the knowledge necessary to make informed decisions that align with your long-term financial objectives and aspirations for financial independence and stability.

Debt Consolidation Loan: An Engaging Video Guide

Debt Consolidation Loan: An Engaging Video Guide

Empower Your Financial Literacy: Watch Our Informative Video Guide on Debt Consolidation Loans

Unlock the Path to Financial Freedom through Debt Consolidation Loans A debt consolidation loan is specifically designed to combine multiple debts into one manageable monthly payment, thereby simplifying your overall debt management process. By consolidating debts, you may find the opportunity to lower your total interest rates and streamline your financial obligations. This informative video guide leads you through the benefits and considerations of obtaining a debt consolidation loan, ensuring that you are well-equipped with knowledge and confidence before making any financial commitments. Join us as we delve into how this financial solution can pave the way towards a more secure and stable financial future.

UK Debt Statistics: Will You Be Impacted?

UK Debt Statistics: Will You Be Impacted?

Essential Insights on Debt: Critical UK Statistics That Could Affect You

Are You Among the Many UK Residents Grappling with Debt Challenges? Recent findings from the Office of National Statistics reveal that UK households are currently burdened with a staggering £119 billion in household debt. This daunting figure underscores the financial hardships faced by many individuals, particularly during these uncertain economic times. With increasing living costs, job insecurity, and unexpected expenses, it is essential to be aware of your financial landscape. This article provides a comprehensive analysis of the current state of debt in the UK, assisting you in determining whether you are affected and offering strategic guidance on potential solutions and effective techniques for managing your financial obligations, ultimately achieving stability and peace of mind.

[/vc_column>

The Article Interest Rates Rise: Be Ready for the Consequences Was Found On https://limitsofstrategy.com