Essential Strategies for Managing Debt During Furlough Periods

Essential Strategies for Managing Debt During Furlough Periods

The COVID-19 pandemic has significantly disrupted the UK economy, leading to widespread furloughs and layoffs in various sectors. As a result, many individuals are facing intense financial strain and the challenge of managing existing debts while dealing with reduced income. If you find yourself on furlough for an extended period, the task of managing your debts can seem daunting, especially when you are receiving only 80% of your regular salary. However, by applying effective strategies, you can navigate this difficult economic landscape and work towards reducing your debt. Here are actionable steps you can take to proactively manage your finances during these challenging times and prepare for recovery.

1. Create a Customized Monthly Budget That Reflects Your New Financial Reality

Begin your financial journey by developing a personalized monthly budget that accurately represents your current financial situation. This budget should take into consideration your reduced income while also highlighting your potential to save effectively. Spend time evaluating your spending patterns and consider reallocating funds from non-essential expenses, such as entertainment and dining out, to cover your essential bills and savings. By prioritizing your financial obligations and minimizing discretionary spending, you can create a sustainable budget that allows you to manage your debts more effectively and prepare for any future financial challenges.

2. Identify Additional Income Streams to Offset Your Reduced Salary

To successfully meet your debt repayment obligations, it is essential to find ways to compensate for the 20% salary reduction. Look for alternative sources of income, such as freelance opportunities or part-time jobs, and consider reducing expenses by canceling underused subscriptions or re-evaluating your grocery shopping practices. Implementing a budget-friendly meal plan can drastically cut your monthly costs. By actively seeking these additional income sources and savings opportunities, you will be better equipped to fulfill your debt commitments and avoid falling behind during your furlough.

3. Investigate Debt Consolidation Loans to Simplify Your Financials

Consider applying for debt consolidation loans for individuals with bad credit. These financial solutions can help streamline your payment process by combining various debts into one manageable monthly payment. This consolidation can reduce confusion regarding multiple due dates and payment amounts, making it much easier to plan your finances. For those on furlough, a <a href="https://limitsofstrategy.com/debt-consolidation-loan-calculator-for-effective-budgeting/">debt consolidation loan</a> can provide a structured approach to managing a limited income, alleviating the stress of juggling multiple payments and enabling you to regain control over your financial situation.

4. Strategically Plan for Your Future Financial Stability and Goals

While dealing with current financial hardships, it’s crucial to keep your long-term goals in focus, such as home ownership or starting your own business. Setting these future aspirations can motivate you to enhance your financial health. Moreover, a debt consolidation loan can assist in improving your credit score, paving the way for better mortgage or business loan options with more favorable interest rates. By strategically planning and striving for your financial objectives, you position yourself for success and can work towards achieving greater financial independence in the future.

For expert advice and further assistance on managing your finances during the pandemic, and to understand how debt consolidation loans can benefit those on furlough, don’t hesitate to reach out to Debt Consolidation Loans today.

If you are a homeowner or a business owner, contact the experts at Debt Consolidation Loans today to learn how a debt consolidation loan can positively influence your financial stability and health.

If you believe a Debt Consolidation Loan is aligned with your financial goals, don’t hesitate to contact us or call 0333 577 5626. Take the crucial first step towards enhancing your financial situation with a single, manageable monthly repayment.

Discover Essential Financial Resources for Expert Guidance:

Consolidate My Medical Loan: Is It Possible?

Consolidate My Medical Loan: Is It Possible?

Can You Successfully Consolidate Your Medical Loan?

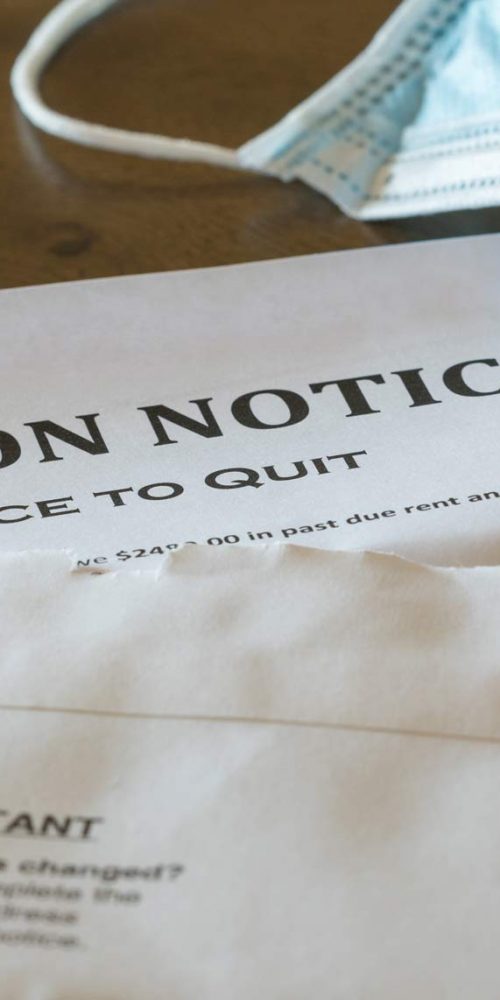

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March: What You Need to Know

Get Out of Debt Quickly: Effective Strategies to Consider

Get Out of Debt Quickly: Effective Strategies to Consider

Rapidly Reduce Your Debt: Effective Strategies to Implement

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

Understanding the Pros and Cons of Debt Consolidation Loans in the UK

Debt Consolidation Loan Calculator for Smart Financial Planning

Debt Consolidation Loan Calculator for Smart Financial Planning

Optimize Your Financial Planning with Our Debt Consolidation Loan Calculator

The Article Furloughed and in Debt? Key Actions You Must Take Was Found On https://limitsofstrategy.com

Recommended Resources for Further Learning:

<a href="https://limitsofstrategy.com/furloughed-and-in-debt-key-actions-you-must-t

This post resonates deeply with me, especially in light of my own experiences during the pandemic. Like many, I found myself navigating a vastly different financial landscape once furlough set in. The idea of creating a customized monthly budget is something I wish I’d thought of earlier. In those initial weeks, I tried to keep everything in my head, thinking I could manage it without a solid plan. However, as bills piled up and expenses seemed to multiply, it really hit home that having a clear picture of my income and outgoings was essential.

It’s striking how many people felt that upheaval during the pandemic, and your experience highlights a common struggle. Trying to keep everything in your head often leads to more stress, especially when financial pressures ramp up. Creating a budget can seem daunting at first, but it’s about crafting a clear picture that makes things feel more manageable.

I appreciate how you emphasized the importance of creating a customized monthly budget during these challenging times. When I was furloughed earlier this year, I found that breaking down my expenses into essential and non-essential categories helped me gain a clearer understanding of where I could make cuts while still maintaining some quality of life. For example, I reduced dining out and focused more on home-cooked meals, which not only saved money but also became a fun family activity!

Creating a customized monthly budget is certainly a necessary skill, especially when unexpected situations arise, like being furloughed. It sounds like you took a proactive approach, which is key. Your method of breaking down expenses into essential and non-essential categories is spot on; it’s surprising how many people overlook that simple step.

I get what you’re saying about breaking things down into essential and non-essential categories. It’s like trying to distinguish between that mysterious leftover in the fridge that you’re not sure about and the delicious takeout from last week that you definitely should not regret.

I completely resonate with the emphasis on creating a customized budget! During my own furlough experience, I found that re-evaluating unnecessary subscriptions and optimizing my grocery spending made a significant difference. It’s fascinating how revisiting seemingly small expenses can lead to unexpected savings.

It’s interesting to hear how your furlough experience prompted a deeper look into your spending habits. The action of re-evaluating subscriptions is something many people overlook, particularly since those monthly payments can slide under the radar, adding up over time without notice. It’s often the case that folks subscribe to services during a brief moment of enthusiasm but rarely go back to consider whether they’re still relevant or needed.